Joseph Jerome

Affiliations. Postdoctoral Researcher, University of Liverpool

A213, Ashton Building

Ashton Street

Liverpool, L69 3BX.

A researcher working in the field of financial machine learning, statistics and mathematics. Recently, I finished a postdoc in the Department of Computer Science at the University of Liverpool working with Professor Rahul Savani. In particular, I am interested in designing reinforcement learning (RL) agents which can learn how to act optimally to make markets or optimally execute a large order.

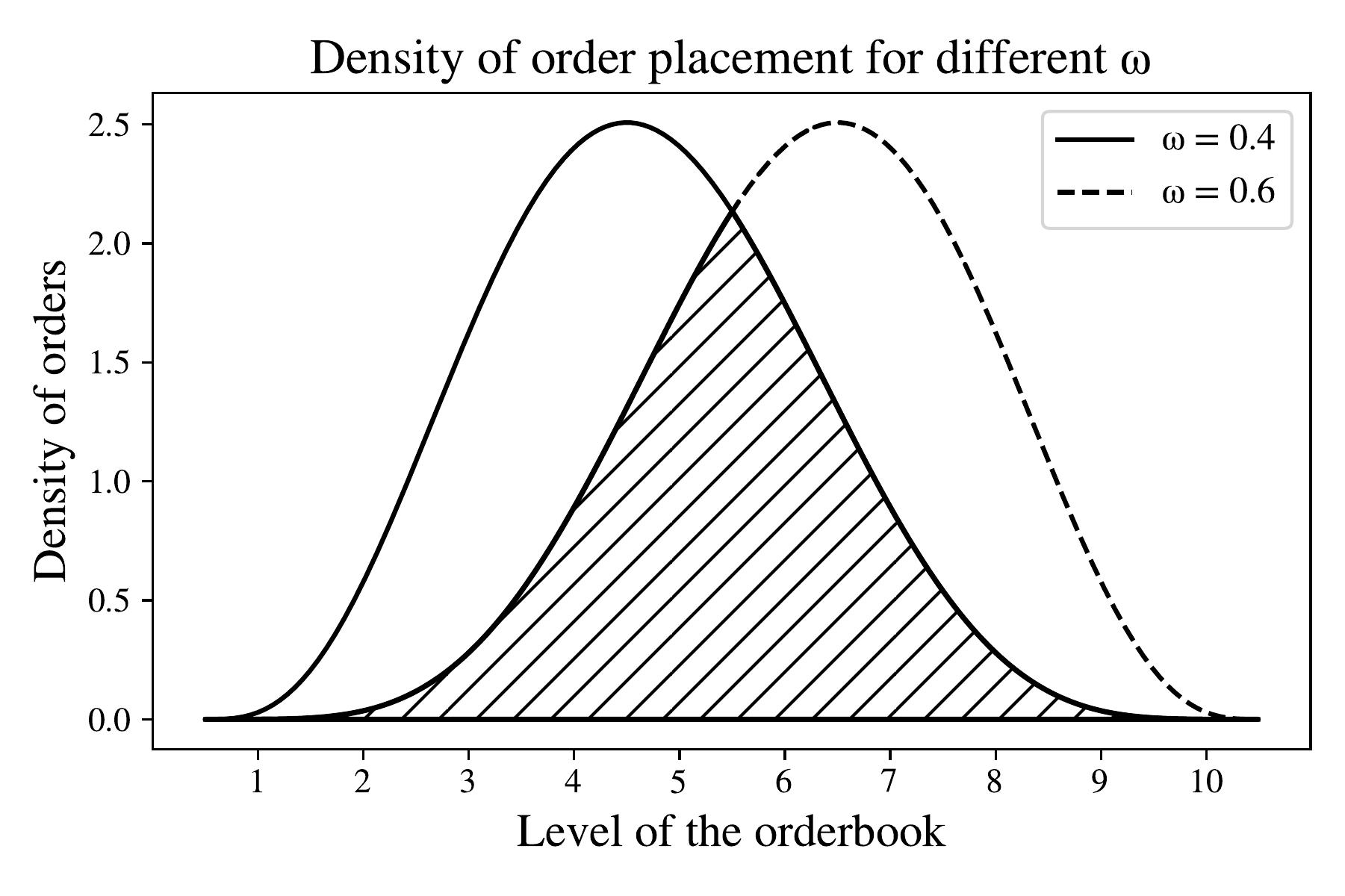

I am also interested in designing better “backtests”, for testing the performance of trading/execution strategies. Since the agent’s interaction with the financial market in turn causes the future dynamics to change, it requires a market model that is adaptive. This is conspicuously missing from almost all backtesting environments, but one way of achieving this is to create a conditional world model of the financial market which generates order flow according to the history of the limit order book up to that point. A popular choice for the world model is to use an analytical model of the orderbook dynamics with a concrete mathematical representation. However, this suffers from a variety of issues that arise due to the inability of the chosen model to reproduce “empirical facts” observed in real-life limit order books due to its simplicity. An exciting alternative is to “learn” the orderbook dynamics using a deep generative model such as a conditional GAN or a conditional VAE. This enables much more complex dynamics to by captured and the realism of the simulated orderbook to vastly improve. One can then train a reinforcement learning agent to optimally make markets in this environment. Recently, I have been working on improving a conditional GAN model for order flow with my industry collaborators at JP Morgan.

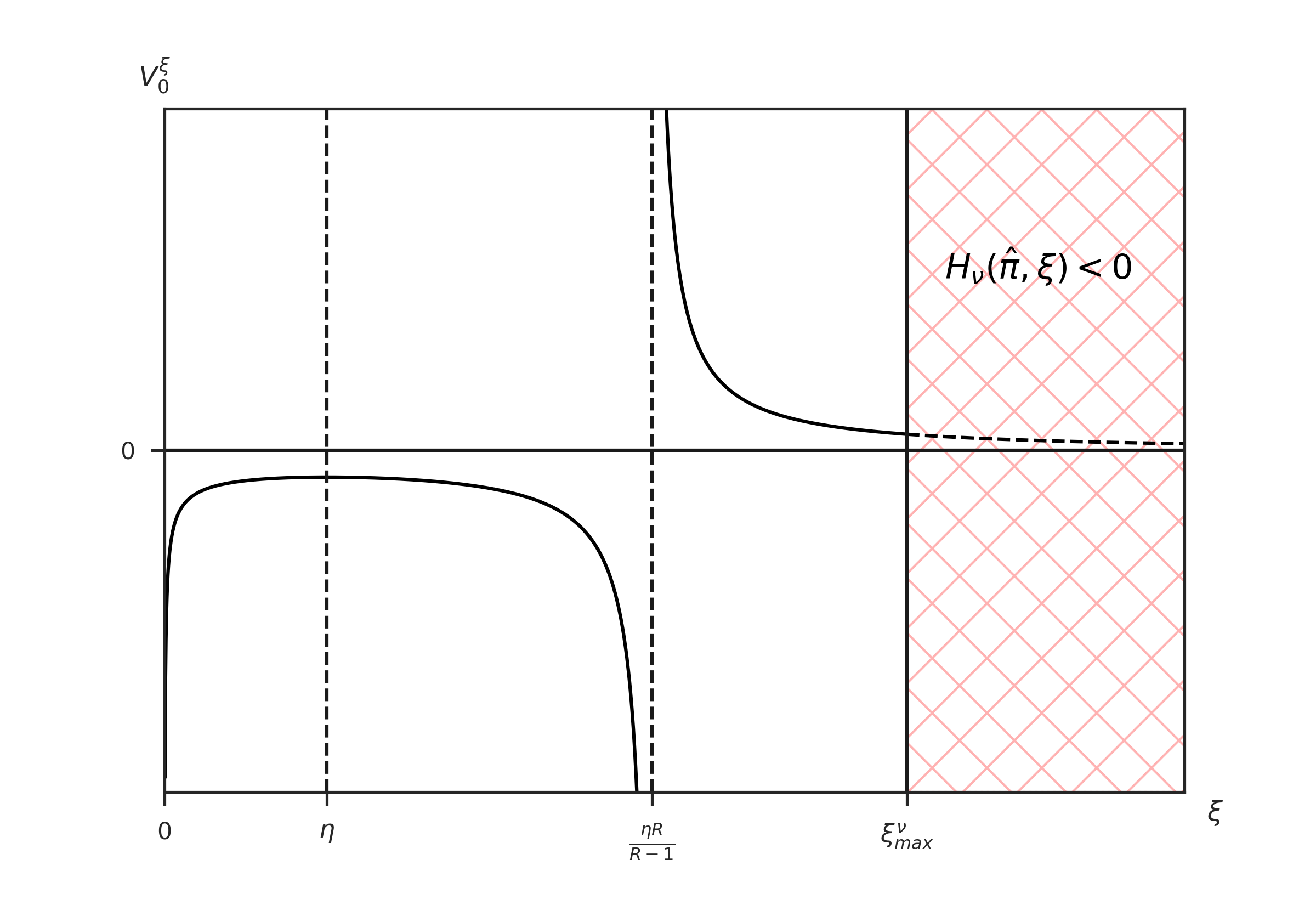

Before joining Liverpool, I did my PhD in Statistics at the University of Warwick under the supervision of Professor David Hobson and Dr Martin Herdegen, where I worked on problems on financial stochastic optimal control. In particular, I researched a variant of Merton’s optimal investment-consumption problem where the agent’s preferences are given by stochastic differential utility.

Here is a link to my Liverpool webpage.

selected publications

-

Conditional Generators for Limit Order Book Environments. Explainability, Challenges, and RobustnessarXiv preprint arXiv:2306.12806 2023

Conditional Generators for Limit Order Book Environments. Explainability, Challenges, and RobustnessarXiv preprint arXiv:2306.12806 2023 -

The infinite-horizon investment–consumption problem for Epstein–Zin stochastic differential utility. I. FoundationsFinance and Stochastics 2023

The infinite-horizon investment–consumption problem for Epstein–Zin stochastic differential utility. I. FoundationsFinance and Stochastics 2023 -

-

Model-based gym environments for limit order book tradingarXiv preprint arXiv:2209.07823 2022

Model-based gym environments for limit order book tradingarXiv preprint arXiv:2209.07823 2022 -